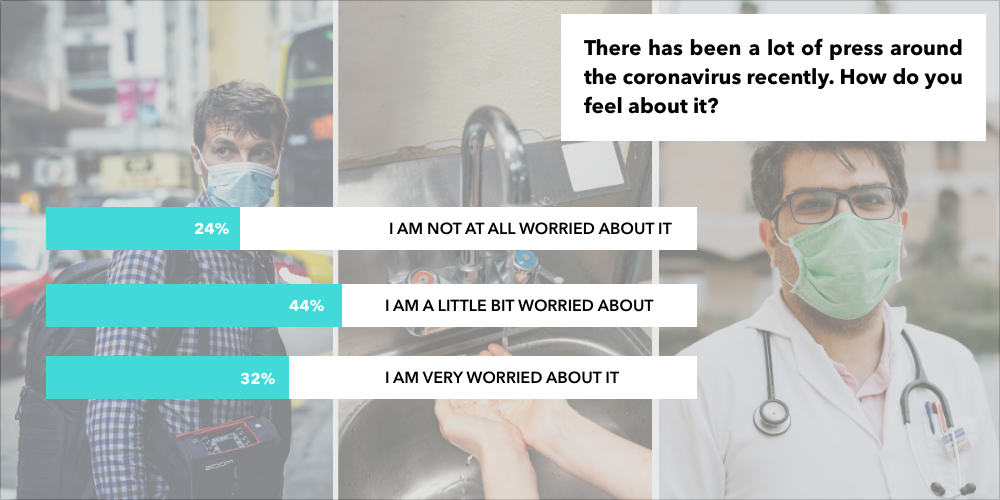

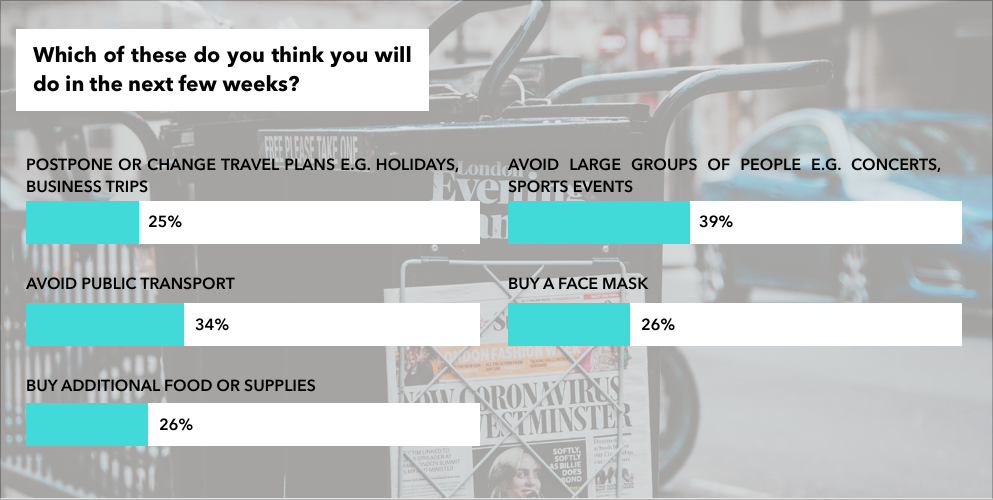

Our Covid-19 Tracker charts the changing daily attitudes and behaviours of 1000s of global consumers – capturing real customer voice and forecasting future consumer trends. As Government restrictions ease, our week eight report takes a detailed look at the changing face of the Post Covid-19 consumer.

Click below to download our full report, tracking the thoughts, feedback and opinions of our global community from the onset of the crisis.

- Anxiety levels have levelled off over the last two weeks with the overall average reducing marginally from 62% to 60%.

- Negative sentiment continues to dominate the minds of our community members – especially in the UK and Brazil.

- Concerns about family members catching the virus remain the biggest worry. Financial worries and boredom are on the rise, especially in the US and UK.

- Users continue to move to online shopping across the majority of our communities – as social distancing guidelines remain in place. However, the declining trend in the UK and Brazil continues with around 15% in Brazil and 4% in the UK now shopping online.

- With the easing of lockdown, the trend of stockpiling is settling down in France and Italy. Across other communities, however, this remains unstable with spikes being observed in the US, UK and Brazil.

- Key positives emerging from Covid-19 are a bigger focus on health, fitness, nutrition and hygiene. Lockdown has also encouraged people to address their work/life balance and spend more quality time with family.

- COVID-19 has brought about a number of learnings which will bring change to our users’ day-to-day attitudes and behaviours, including being ‘pandemic-ready’ and recognising the importance of their healthcare systems and infrastructures.

- Unemployment continues to rise – particularly in the US and Brazil.

- We are also observing an increase in those working less than they did before, meaning those still working are having hours and shifts cut.

- Working from home has declined in Italy and France with governments encouraging people to return to work. However, it continues to rise in other countries.

Satisfaction with Government varies across countries

- Satisfaction with Government response and actions has improved in the US, while it remains moderate in Italy and the UK, and low in France and Brazil. While people feel that the government is taking initiatives to support them in the US, the easing of lockdown is not being supported in the UK,

- The dissatisfaction in France and Brazil stems from the perception of delayed response, lack of enough PPE and financial benefits not reaching the people.

- Opinions stand divided on press coverage and behaviour; while most find it informative, accurate and helpful, others find it to be a source of overly negative and depressing information.

- Low perception of news being positive, rather perceived to be extremely negative in France with low objectivity.