With Black Friday looming, the war for the customer’s attention is on. And, with easing lockdowns and life returning to normal, the online/in-store debate is the hot topic for brands trying to get ahead. Will customers be desperate to get back into the shopping malls post-covid, or will a Black Friday spent in lockdown have taught consumers a more peaceful alternative to fighting with fellow bargain hunters over the last discounted TV?

Having originated in the US, Black Friday’s popularity is snowballing globally, with 60% of our global community intending to take part this year. And, with offers released earlier and earlier every time, this flurry of sales is no longer contained to just one day. But, with this year marking the first time payday takes place after Black Friday weekend, brands are clambering to know whether hunger for discounts or the ‘hold on till payday’ mentality will win.

So, how can your brand get ahead of the competition? The secrets to success have been revealed by our global, always-on consumer insight community…

Unlock the Black Friday predictions here…

When asked ‘how diverse is your brand’ and ‘how inclusive is your company’, some might believe the two questions are merely synonymous. But they’re not just the same question repackaged. According to Forbes, diversity is the ‘what’: who is sitting at the table. Inclusivity, on the other hand, is the ‘how’, the brand culture that allows diversity to prosper: have you pulled up extra chairs to that table?

When 72% of our insight communities believe that brands have a responsibility to be involved in D&I conversations, it’s more important than ever for your brand to embrace an equal and inclusive future. However, despite our online panel being overwhelmingly in favour of brand activism, more than half of them were untrusting of the brands that allied themselves with these causes.

How can brands overcome this double bind of championing progressivism without being damned as inauthentic? We caught up with Ellis Lanyon, Head of Digital for NYX Professional Makeup, Network Chair of L’Oréal UK & Ireland’s LGBTQ+ Employees and Allies Network OUT@L’Oréal, and a British LGBT Award Nominee 2020. He told us how NYX Professional Makeup, a pioneering brand for gender, sexual and racial equality, are working towards a more inclusive future.

Here’s what Ellis, as well as our insight communities, had to say…

Unlock the expert advice from L’Oréal UK & Ireland…

As the UK begins to reopen and cities blossom with life once again, we checked in with our community to see if they were excited for the return of the hospitality industry.

Here’s what they had to say…

Though there was eagerness to return to a life that isn’t defined by masks, working from home and zoom quizzes, there was consternation over safety.

That being said, half of the community were willing to try a bar or pub that had a lively atmosphere and a lot of customers.

The industry should anticipate customers ready to spend on premium products, and prepare for the digitalisation of service.

The key insights around the future of socialising…

Join us for an hour of insights examining emerging consumer behaviours as we return to eating and drinking in public spaces like coffee shops, restaurants and bars.

We’ll look at consumer perspectives on how the service industry has reacted and chart the key consumer trends impacting the future for brands.

Featuring industry experts:

👉 Rhys Humm: New Business Development, Costa Coffee

👉 Elizabeth Davies: Senior Category Manager, Budweiser Brewing Group

👉 Louise Hughes: Collaboration Director, Bulbshare / Retail Strategy Expert, Boots, Reckitt Benckiser, AB InBev

👉 Sebastian Szczukiewicz: Client Collaboration Lead, Bulbshare

Request our webinar recording now to unlock all the insights…

Request our webinar recording now to unlock all the insights. Just share your details below and we’ll email you with a link…

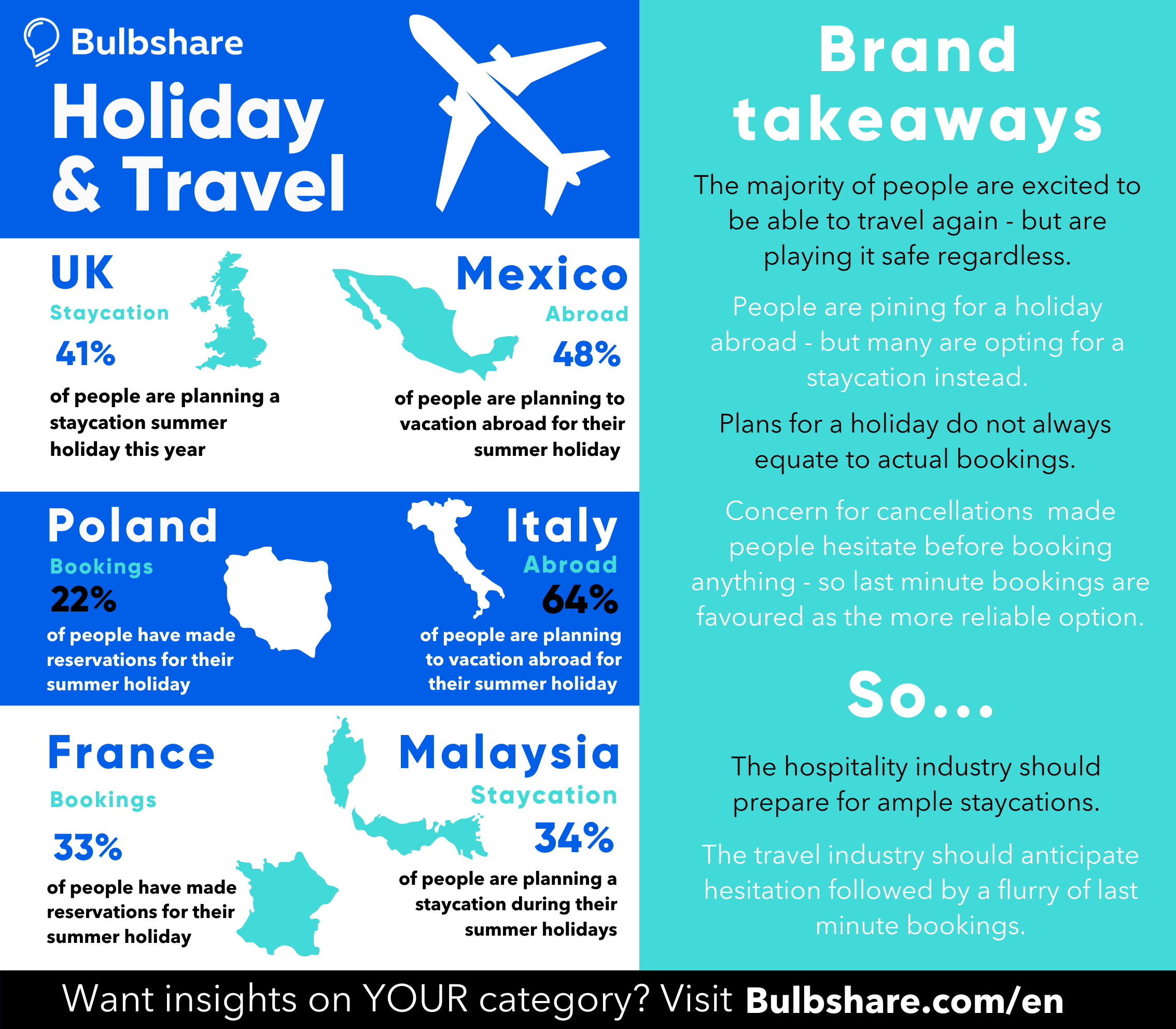

The UK’s new traffic light system has everyone eagerly hanging on for the green light for holidays abroad. So, we approached our global insight community and asked them if they’re desperate to be relaxing on an exotic beach somewhere – or if they prefer the safety of home this year.

Here’s what they had to say…

“Because, after having so many obligations and duties during lockdown, I would like to relax and be treated. But above anything else, travel is good for our economy.” – Bulbshare user, Male, 43, Italy

Despite restrictions, ambiguity and costs, there is a shared enthusiasm for travel amongst all communities. 78% of our Polish users, 84% of our Italian users, 92% of our Malaysian users and 64% of our UK users all have their fingers crossed for a holiday this year. Whether that translates to bookings and plans is another question, so travel agencies will have their work cut out for them in converting desire into determination…

The key insights around the future of brand advocacy

Join us for unmissable insights around the power of customer communities – and why they are shaping the future for brands. Just request our webinar to discover the importance of building online customer communities, the power of customer advocacy, the role of user-generated content for businesses and the changing idea of ‘authenticity’ for modern audiences!

Featuring industry insiders:

👉 Gordon Glenister: Head of Influencer Marketing, BCMA

👉 Louise Hughes: Collaboration Director, Bulbshare

Request our webinar recording now to unlock all the insights…

With the UK tentatively reopening next week, we asked our community how they felt about heading back out for a pint! On the cusp of so much change, we wanted to know whether they feel cautious about going out for the first time in so long or are rearing to go…

It’s safe to say, our community were excited to be back out, with a beer in hand!

Check out the infographic to discover what our UK market research communities had to say about drinking and dining this summer.

“I am excited to have more freedom to enjoy time with family and friends again” – Bulbshare user, Female, 55, UK

80% feel comfortable going to BBQs and picnics, 63% are heading back to bars and pubs and 78% are going to beer gardens. It’s safe to say the hospitality industry will have a lot on their plates this summer; seats will be full in pubs, restaurants and bars for the first time in months.

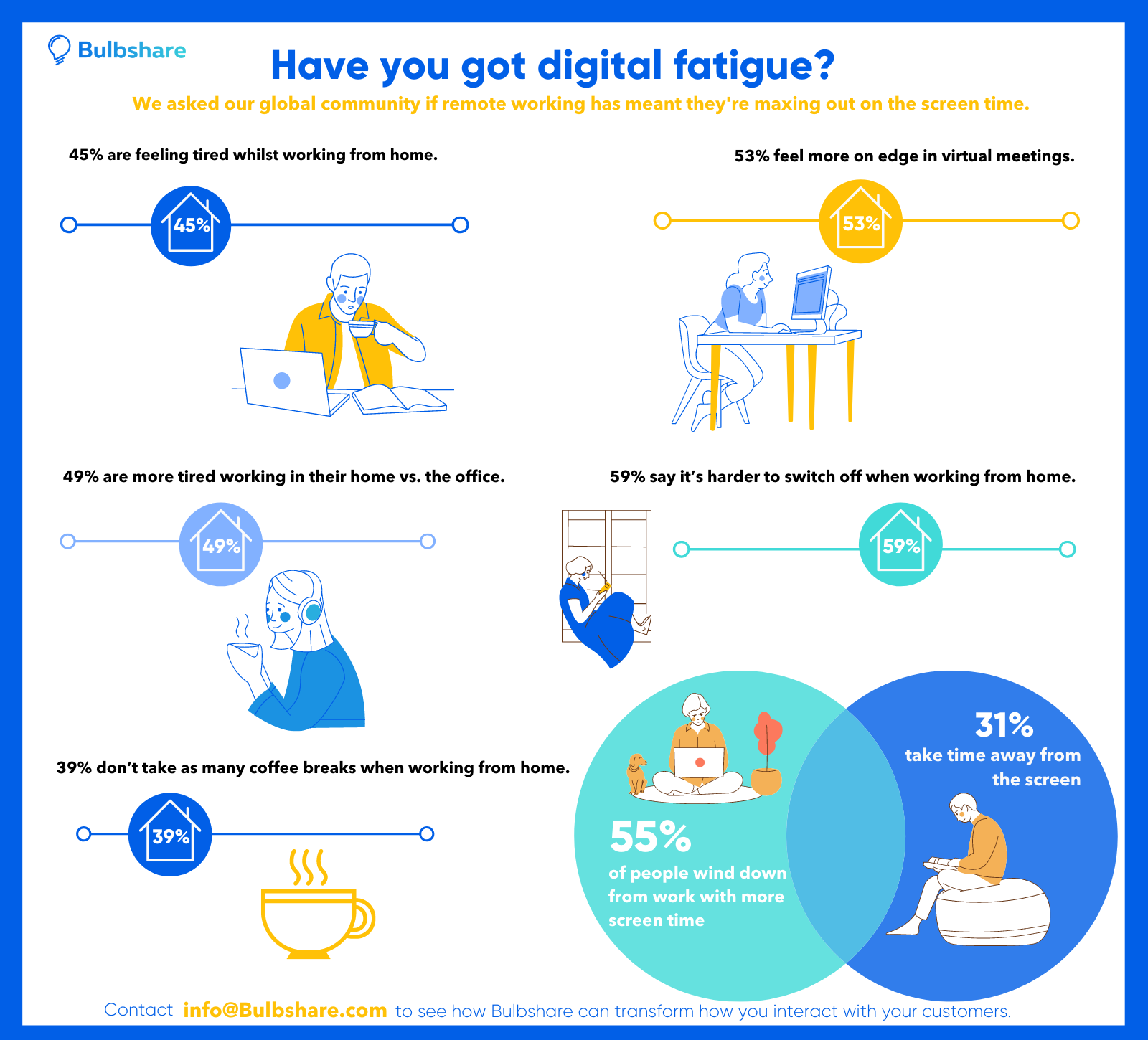

Working from home has become the new normal. And with the world’s transition to remote working well under way, we are all wondering whether a full return to the office will ever be a possibility.

So, we checked in with our Bulbshare community to gauge their thoughts and feelings on working from home, burnout, and digital fatigue. With all this time online, we wanted to know if the blurring of work and home is making them more tired and less productive – or if they are loving this new homebody lifestyle!

Check out our digital fatigue infographic below to discover the insights…

“The boundary between work and home is often much blurrier” – Bulbshare user, Female, 34, UK

When 59% of our digital communities said they found it harder to switch off mentally after work and 39% take fewer breaks, it is clear that our focus groups are feeling burnt out. With such heightened anxiety, loneliness and exhaustion from all the time away from reality and colleagues, it’s time to look to new ways of forming connections and fostering togetherness.

There is no better way of simulating that sense of companionship in these remote and isolating times than through virtual communities.

To find out how these insights could benefit your business, get in touch at info@bulbshare.com.

Consumer insight communities are fast becoming an indispensable part of brand strategy when it comes to building connections and truly understanding your customers.

More and more leading global brands are investing in these types of direct relationships and with 88% of Bulbshare’s global insight communities reporting they are eager to be involved in brand decisions, the desire to connect is clearly reciprocated by consumers.

So, what are the secrets to building and maintaining these communities, and how can you best utilise them to be truly customer-led and turn your customers into friends, followers and fans?

Unlock the answers with Bulbshare’s ten-step toolkit. Just fill in your details below then check your inbox…

The key consumer shopping trends post lockdown and what they mean for retail, brands and shopping centres.

How will our idea of the high street and shopping centres evolve over the next 12 to 18 months? What does it mean for brands and what are the retail trends set to shape the future?

Join us for an hour of insights as we look at the key consumer shopping trends post lockdown, examine the impacts for brands and offer expert guidance on how to react.

Featuring an industry expert panel:

– David O’Shea: Director, Time Retail Partners

– Louise Hughes: Collaboration Director, Bulbshare / Ex Retail Strategy Expert, Boots, RB, AB InBev

Request our webinar recording now to unlock all the insights…

As our idea of the highstreet evolves over the next 12 to 18 months, how will shopping be affected, and what does this mean for brands, supermarkets and retailers?

Featuring an industry expert panel:

– Simon Betts: Client Director, Bridgehead International / Ex Head of Customer Proposition, Tesco

– Louise Hughes: Collaboration Director, Bulbshare / Ex Category Controller ABInBev / Boots

Request our webinar recording now to unlock all the insights…

More and more brands are rethinking their strategies when it comes to digital marketing. While influencers used to be the first point-of-call, many are now looking to a new army of advocates when it comes to shouting about their products and services online… Their customers.

With a growing scepticism towards influencers among younger audiences, (only 4% of consumers still trust influencer posts according to a recent report by YouGov), turning to real customers to promote your brand adds a sense of authenticity that is lacking in sponsored content. And the smart brands are exploring new ways to unleash the peer-to-peer power of their customers at scale.

So, how does consumer advocacy work? And what are the steps to turning your customers into friends, fans and loyal brand champions?

How will our idea of the high street evolve over the next 12 to 18 months? What does it mean for brands and what are the retail trends set to shape the future?

Featuring an industry expert panel:

– Simon Marsden: Category Development Manager, Tesco

– Louise Hughes: Collaboration Director, Bulbshare / Ex Category Controller ABInBev / Boots

Request our webinar recording now to unlock all the insights.

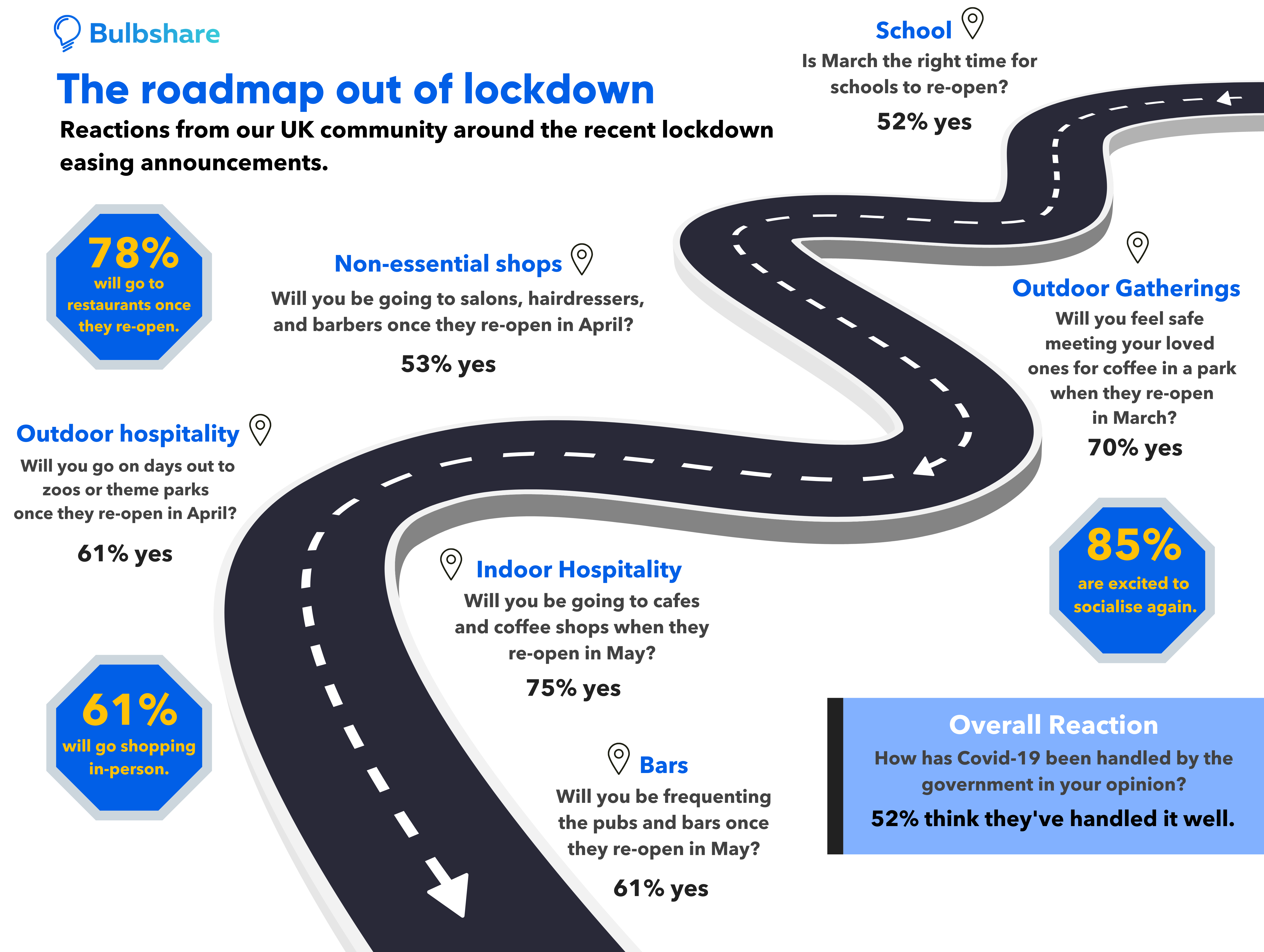

With the UK hopeful for a future free from Covid restrictions, it’s time to connect with our customer communities to see how they’re feeling about escaping lockdown.

Hundreds of our UK community members responded with rich insights about the government’s new roadmap, which has set out dates and plans for when hospitality, retail and travel can resume.

To discover the reaction of our communities, read on below…

Join an expert discussion around the post-Covid consumer behaviour shifts set to impact the drinks industry this year…

Featuring industry insiders:

– Paul Thomas: Global Insight Director, Asahi, Ferrero, Diageo

– Louise Hughes: Collaboration Director, Bulbshare (Ex Category Controller ABInBev)

Download our webinar for all the insights…

Join our panel of industry experts as they share key insights on what a Christmas of closed bars and pubs could mean for the drinks industry…

Thought-leading panel, including:

– Paul Thomas, Global Insight Director, Asahi

– Liz Davies, Category Lead, Budweiser Brewing Group

– Seb Szczukiewicz: Drinks Industry Insight Specialist, Bulbshare

Our Covid-19 Tracker charts the changing daily attitudes and behaviours of 1000s of global consumers – capturing real customer voice and forecasting future consumer trends. As Government restrictions ease, our week eight report takes a detailed look at the changing face of the Post Covid-19 consumer.

Click below to download our full report, tracking the thoughts, feedback and opinions of our global community from the onset of the crisis.

Satisfaction with Government varies across countries

Our Covid-19 Tracker charts the changing daily attitudes and behaviours of 1000s of global consumers – capturing real customer voice and forecasting future consumer trends. As lockdown eases, our week six report begins to explore the post Covid-19 consumer.

Click below to download our full report, tracking the thoughts, feedback and opinions of our global community from the onset of the crisis.

Mental Health

• With lockdown beginning to ease, we are starting to see a decline in levels of anxiety – with those who ‘feel anxious about the situation’ falling from 70% to 62% over the last three weeks.

• Negative sentiment continues to dominate the minds of our community members – especially in the US and Italy.

• Concerns about family members catching the virus remain the biggest worry. Financial worries are also on the rise.

Shopping

• Users continue to move to online shopping across the majority of our communities – as social distancing guidelines remain in place. However, we have seen a decline of around 10% in the UK and around 19% in France over the last week.

• Numbers of users stockpiling continues to go up and down, with no clear pattern emerging. This week we have observed a spike in Italy and the US, but seen a sharp decline in the UK, France and Brazil.

‘New Normal’

• Key positives emerging from Covid-19 are a bigger focus on health, fitness, nutrition and hygiene. Lockdown has also encouraged people to address their work/life balance and spend more quality time with family.

• Covid-19 has brought about a number of learnings which will bring change to our users’ day-to-day attitudes and behaviours. These include being ‘pandemic-ready’, planning food resources better and having more appreciation of family time.

Work

• Unemployment continues to rise – particularly in the US and Italy.

• We are also observing a rise in those working less than they did before, meaning those still working are having hours and shifts cut.

• Working from home continues to rise. We anticipate seeing a slow decline here as governments across our communities begin to encourage those who can do so to return to work.

Satisfaction with Government varies across countries

• High satisfaction with Government response and actions in Italy, moderate in US and UK, and low in France and Brazil. The dissatisfaction stems from the perception of delayed response, lack of enough PPE and financial benefits not reaching the people.

• Users generally feel that governments have taken the right decisions on social distancing, lockdown and isolation.

Response on press coverage

• Opinions stand divided on press coverage and behaviour; while most find it informative, accurate and helpful, others find it to be a source of overly negative and depressing information.

• Low perception of news being positive, rather perceived to be extremely negative in the UK and Italy with low objectivity.

In the last six weeks, the outbreak of Covid-19 has irreversibly transformed our lives. Our homes are no longer just homes, they are offices, classrooms, and gyms. We are cut off from friends and family, and socialising via screens. We are living, shopping, working differently.

Across the globe, thousands have lost their lives, and millions have lost their livelihoods. Governments are taking drastic, unprecedented measures to support their economies, their health systems and their people, while individuals are doing what they can to raise money and moral.

Amidst the turmoil have been beacons of light. In a time of isolation, the idea of community has never been more important. We’ve seen waves of clapping, live music from balconies, army captains raising millions. We’ve seen businesses stepping in to donate ventilators, and industry turning its hand to new innovations.

Global brands have also been going above and beyond to help out in this time of need – with everything from simple donations to far-reaching support initiatives. With that in mind, we asked our global insights community to tell us who their brand heroes have been during the epidemic. Here’s a list of their top five. It’s as surprising as it is inspiring…

DoorDash

Food delivery services like DoorDash and UberEats have become game-changers in a world where going out to eat is prohibited, providing meals to families every day, while promoting health, safety and social distancing. Both DoorDash and UberEats are providing free protective equipment to their employees. DoorDash has also rolled out a commission relief and marketing support programme for independently owned restaurants that could be hurt by lack of customers. They have added more than 100,000 small businesses to their app, offering no commission fees, $0 delivery fees, and over $20 million in marketing efforts to generate revenue for independent restaurants already on the app.

(Bulbshare user, 34 🇺🇸)

(Bulbshare user, 33 🇧🇷)

Google

Google is supporting people in more ways than one. They are making it easier to stay connected with loved ones, co-workers, and students when virtual communication is the only option, by making premium features of their Google Hangout technology free to everyone. In addition, Google has led the way with unique relief efforts, such as giving $25 million worth of advertising credit to the World Health Organization (WHO) and donating over $1 million to purchase medical supplies and provisions for frontline workers. Google technology is also being used in the research of the virus’s structure.

(Bulbshare user, 43 🇲🇽)

(Bulbshare user, 30 🇷🇺)

Verizon

With our work, education, and social lives now being entirely online, having access to wireless data is essential. Verizon, along with many other phone service providers like AT&T, Vodafone and Telstra are making sure their customers can still afford to stay connected on their devices. Verizon is waiving all late, international, activation, and upgrade fees, and offering free extra data plans up to 15GB. And, they have a variety of free calling packages and learning tools available for healthcare workers and teachers.

(Bulbshare user, 47 🇬🇧)

(Bulbshare user, 37 🇦🇺)

Alcohol Distilleries

Hundreds of gin, vodka, whiskey, and beer distilleries and breweries all over the globe are halting their alcohol production and switching to making hand sanitiser in an effort to keep up with demand while keeping it at affordable prices – AND keeping their employees on the payroll. Popular brand names in the UK like BrewDog have donated sanitiser to local charities and care facilities. 58 Gin has even created personalised bottles of hand sanitiser, where you can pick your own scent, colour, and label. Our online focus groups reacted well to examples of brand compassion such as this.

(Bulbshare user, 37 🇬🇧)

(Bulbshare user, 39 🇺🇸)

The Body Shop

While cosmetics brands may not come to mind right away in the fight against Covid-19, The Body Shop is setting an excellent example of tackling issues that are a direct result of the virus. In addition to keeping all of its employees on their payroll and donating over 30,000 soap products to vulnerable communities and hospitals, they have teamed up with NO MORE to support and provide resources to those trapped in domestic abuse situations due to stay at home mandates.

(Bulbshare user, 39 🇬🇧)

The real heroes – the front-line health workers

And of course, our global research community is thankful for all the health care providers facing the coronavirus head on every day – the real heroes risking their lives to protect and care for those affected.

(Bulbshare user, 34 🇵🇱)

(Bulbshare user, 38 🇺🇸)

Our Covid-19 Tracker charts the changing daily attitudes and behaviours of 1000s of global consumers – capturing real customer voice and forecasting future consumer trends. Click below to download our full week four report, tracking the thoughts, feedback and opinions of our global community from the onset of the crisis.

Mental Health

• As the lockdown continues, the levels of anxiety remain high – with 74% of respondents feeling anxious. Of all our communities, the most significant spikes in anxiety levels during week four can be observed in Italy.

• Despite a slight improvement vs week three, negative sentiment towards the current reality continues to dominate the minds of our community members.

• Concern about family members catching the virus remains high week-on-week . However, fears around financial worries/job security continues to increase – being most prevalent in the US.

Shopping

• Moving to online shopping remains high across most of our global communities – as lockdown and social distancing persists. However, for some communities this has actually fallen during week four, notably Italy and the US.

• Stockpiling continues to increase in the UK, France and Brazil, but has declined in Italy and the US.

• Long-life products and essentials remain the most common items in the basket. Users are continuing to shop for different brands and have started buying more non-food items.

Physical Health

• We are seeing an increase from 39% to 41% of community members reporting that they are exercising less during lockdown.

• The number of people exercising less has increased across all our communities – with the biggest decrease in exercise coming in Italy.

• While many are exercising less, there are also those exercising more during lockdown, with many moving to online fitness classes.

Social Distancing and Isolation

• Social distancing is becoming harder as people miss their families and friends. In week four, the pressure and fatigue of lockdown is increasing significantly.

• Despite this, we continue to observe a number of positives – spending more time with family being the top of the list.

• Feelings of being trapped, isolated and bored are most common across all of our global communities.

‘New Normal’

• We are seeing more people trying a new diet or simply exploring new meals or recipes at home.

• Leveraging technology (video calls, PC, online streaming) remains high across all our communities – especially for

connecting with family and friends.

• We have seen an increase in users engaging in new pastimes – reading and audiobooks have been particularly prevalent, especially in the US, UK, Italy and France.

• Online fitness classes have been gaining more traction too , in particular in the UK, US, Brazil and France.

Work

• Concerns about unemployment and financial instability are rising. The level of people not working is still increasing in most of our global communities (only Brazil and France have experienced a decline).

• We have observed a very high incline in users ‘working less than before’ in Italy – from 22% up to 50%.

• Working from home remains a constant theme, though we have now seen some variation:

– In Italy, people are now working less from home (this could be linked to a rise in those not working) – moving from 39% to 13%.

– In Brazil, France and US the numbers of those working from home continues to rise

Our Covid-19 Tracker charts the changing daily attitudes and behaviours of 1000s of global consumers – capturing real customer voice and forecasting future consumer trends.

Mental Health

• Anxiety remains high – at an average of 73% across our communities. This can be worst felt in Brazil where infection and death rates continue to rise.

• We have observed a marginal drop in negative sentiment on anecdotal responses for the first time, as people begin to see a light at the end of the tunnel and the easing of lockdown is beginning to be discussed across some communities.

• Concerns about family members catching the virus remains the most significant fear. However, financial worries and job insecurity is also on the rise.

Shopping

• Online shopping continues across the majority of our communities.

• Stockpiling continues to decline.

• Long-life products, canned good and everyday essentials remain the most common items in the basket – with people continuing to shop for alternative brands where their staple purchases are not available.

‘New Normal’

• Behaviour changes remain largely inline with previous weeks:

• Leveraging technology (video calls, PC, online streaming) remains significant across all our communities.

• Engaging in other, more traditional pastimes such as cooking, reading and crafting is also on the rise.

• We have observed an increase in users subscribing to online education platforms – particularly in the UK and Italy.

• The use of online food delivery companies has also experienced spikes across our UK, Brazilian and French communities.

Social Distancing and Isolation

• We are beginning to observe increased feelings of pressure around lockdown, with isolation fatigue setting in and much negative sentiment being reported around not seeing an end to the crisis.

• Despite this, we continue to observe a number of positives – with spending more time with family continuing to be at the top of the list of good things to come out of lockdown.

Our Covid-19 Tracker charts the changing daily attitudes and behaviours of 1000s of global consumers – capturing real customer voice and forecasting future consumer trends.

Mental Health

• Another week of fear and sadness – anxiety levels average at over 70%. The UK, US and France experience the worst levels of anxiety as infection rates soar.

• Negativity continues to dominate feelings. Sentiment towards the new Covid-19 world is negative in anecdotal responses – ranging from 50% to 83% across communities.

• Worries about family members catching the virus continues to be the number one concern.

• Financial worries are becoming more prevalent in Brazil and Italy.

Shopping

• Online Shopping continues to increase across the majority of our communities.

• Stockpiling begins to stagnate or decline across all our European communities. This is not the case in the US, however, where over 70% of our community members have stockpiled this week (an increase of 28% week-on-week).

• Long-life products and essentials remain most common items in the basket.

‘New Normal’

• Facing this ‘new normal’ continues to drive significant changes in day-to-day behaviour.

• Leveraging technology (video calls, PC, online streaming) his on the rise across all our communities.

• Users across all communities report spending more time with family, exploring more new brands, and appreciating the little things in life more as their goals for a post Covid-19 world.

Social Distancing and Isolation

• Social distancing and staying at home continue to bring positives – with over 80% of our users finding it easy.

• Spending time with family continues to be top of the list when it comes to positives.

• Despite this, people continue to feel trapped and miss contact with other friends and family members.